Use our money-saving tips to find the right auto insurance policy at the right price and lower the cost of your premium.

One of the most costly mistakes you can make with your auto insurance is letting your policy automatically renew.

If you do this instead of looking for a better deal, your insurer can take advantage and increase your premiums.

Therefore, shopping around is one of the best ways to get a cheaper deal on your auto insurance.

1. Limit your mileage

Limit the number of miles you drive each year: Fewer miles means you’re at lower risk to insurers, so it’s cheaper to insure.

But always provide an accurate estimate of your mileage when you get a quote – your policy might not be valid if you’re not honest.

2. Pay annually

Paying monthly for car insurance is a loan, with interest added, so paying for car insurance in a lump sum is cheaper.

If you can’t pay all at once, it’s worth considering other options, such as paying with a 0% credit card; just be sure to make at least the minimum monthly payments and pay off the card balance before interest. the free period ends.

3. Improve security

Consider installing devices like alarms, immobilizers and wheel lock nuts.

Get quotes on how much your insurance would cost before you install any security upgrades, so you can see if the extra cost of them is worth the insurance savings.

4. Increase your voluntary excess

Choosing a higher voluntary excess when taking out your policy will reduce the price of your insurance.

But if you file a claim, you’ll have to pay that excess toward the cost of repairing or replacing your car, so make sure you can afford the excess if you do eventually have to pay it.

5. When to renew your car insurance for the best price

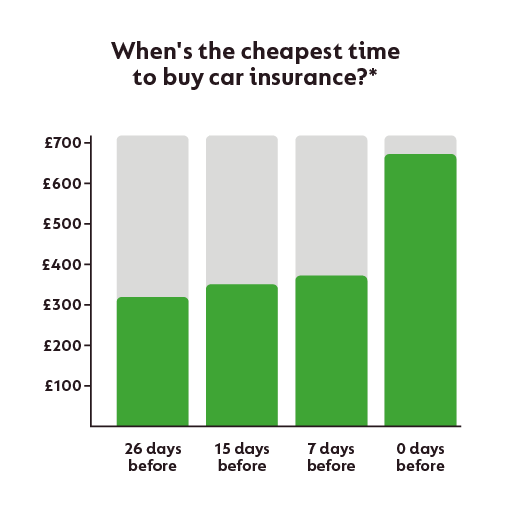

You can buy your auto insurance up to 29 days before your policy start date and ‘lock in’ the quoted price on that day.

And our research shows that it’s best to buy early. The closer to your renewal date, the more you could end up paying your premiums.